Nonresident Alien Compliance

Background

In order to comply with United States income tax laws, the University must determine the tax residency and immigration status of nonresident aliens. The University uses Sprintax Calculus to determine the U.S. residency status for tax purposes based on the information provided by the nonresident alien. All nonresident alien faculty, staff, and students are required to use Sprintax Calculus if they receive any payment from the University.

What is Sprintax Calculus?

Effective October 21, 2024, Loyola University Chicago launched Sprintax Calculus as the tax determination software for international payees (non-U.S. individuals and entities). This software replaces the University’s prior tax compliance software of GLACIER Nonresident Alien Tax Compliance System, which has been discontinued.

Sprintax Calculus is an online tax determination software for international payees of Loyola. It is a secure, web-based system that will classify international individuals and entities for U.S. tax purposes, determine income tax treaty eligibility, the appropriate tax withholding status for income taxes and FICA, and generate any required tax forms.

Accessing Sprintax Calculus

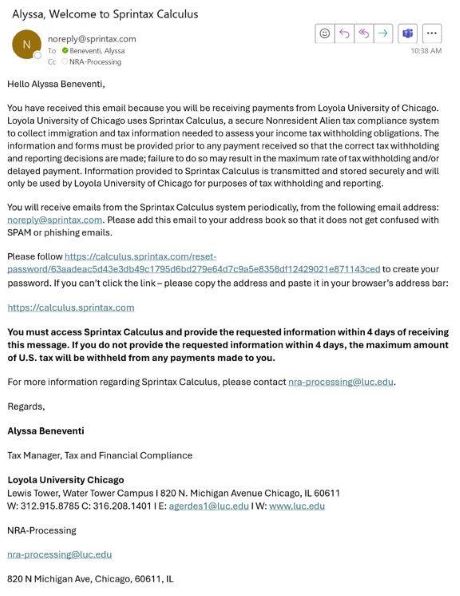

Once Loyola’s tax department has set you up in the system, you will receive an email to your @luc.edu email from noreply@sprintax.com titled “First Name - Welcome to Sprintax Calculus”. This email will be sent to a personal email account only if you do not have a registered luc.edu email.

This email will not be spam or a phishing attempt and you should log in with the provided instructions to complete your profile.

See the sample email below:

If you do not activate your account within 24 hours of receiving this email, you can request a new activation link here: https://calculus.sprintax.com/forgotten-password/ and enter your email. Please check your junk or spam folder if you do not see it right away.

Please complete your Sprintax Calculus profile as soon as possible as a delay can cause your income tax withholdings to be set up incorrectly. You cannot take advantage of any income tax treaty benefits until your profile is complete and your tax forms are signed.

Once I have an account, how do I log in to Sprintax Calculus?

You can log in any time via the following link: https://calculus.sprintax.com/uni/login/

Do I need to complete Sprintax Calculus if I have previously used Glacier?

Yes, every user must access and review their information in Sprintax Calculus, as additional information is required to be provided. Information that was previously provided will be transferred over to Sprintax Calculus, however it will still require the user to verify that all the data is accurate and up to date.

Please visit the Sprintax Calculus User Resources website for specific information on how to navigate Calculus.

What forms should I have available during the review and completion of the Sprintax Calculus profile?

- Form I-20/DS-2019/I-797

- I-94 record (can be accessed here: https://i94.cbp.dhs.gov/I94/#/home )

- Passport page

- Employment Authorization Card (EAD), if applicable

- SSN Card

Background

In order to comply with United States income tax laws, the University must determine the tax residency and immigration status of nonresident aliens. The University uses Sprintax Calculus to determine the U.S. residency status for tax purposes based on the information provided by the nonresident alien. All nonresident alien faculty, staff, and students are required to use Sprintax Calculus if they receive any payment from the University.

What is Sprintax Calculus?

Effective October 21, 2024, Loyola University Chicago launched Sprintax Calculus as the tax determination software for international payees (non-U.S. individuals and entities). This software replaces the University’s prior tax compliance software of GLACIER Nonresident Alien Tax Compliance System, which has been discontinued.

Sprintax Calculus is an online tax determination software for international payees of Loyola. It is a secure, web-based system that will classify international individuals and entities for U.S. tax purposes, determine income tax treaty eligibility, the appropriate tax withholding status for income taxes and FICA, and generate any required tax forms.

Accessing Sprintax Calculus

Once Loyola’s tax department has set you up in the system, you will receive an email to your @luc.edu email from noreply@sprintax.com titled “First Name - Welcome to Sprintax Calculus”. This email will be sent to a personal email account only if you do not have a registered luc.edu email.

This email will not be spam or a phishing attempt and you should log in with the provided instructions to complete your profile.

See the sample email below:

If you do not activate your account within 24 hours of receiving this email, you can request a new activation link here: https://calculus.sprintax.com/forgotten-password/ and enter your email. Please check your junk or spam folder if you do not see it right away.

Please complete your Sprintax Calculus profile as soon as possible as a delay can cause your income tax withholdings to be set up incorrectly. You cannot take advantage of any income tax treaty benefits until your profile is complete and your tax forms are signed.

Once I have an account, how do I log in to Sprintax Calculus?

You can log in any time via the following link: https://calculus.sprintax.com/uni/login/

Do I need to complete Sprintax Calculus if I have previously used Glacier?

Yes, every user must access and review their information in Sprintax Calculus, as additional information is required to be provided. Information that was previously provided will be transferred over to Sprintax Calculus, however it will still require the user to verify that all the data is accurate and up to date.

Please visit the Sprintax Calculus User Resources website for specific information on how to navigate Calculus.

What forms should I have available during the review and completion of the Sprintax Calculus profile?

- Form I-20/DS-2019/I-797

- I-94 record (can be accessed here: https://i94.cbp.dhs.gov/I94/#/home )

- Passport page

- Employment Authorization Card (EAD), if applicable

- SSN Card